SSA Agrees to Stop Suspending Benefits Based on Existence of Arrest Warrant

A U.S. district court has approved a settlement agreement between the Social Security Administration and a group of individua...

Read more Elder Law Answers

Elder Law Answers

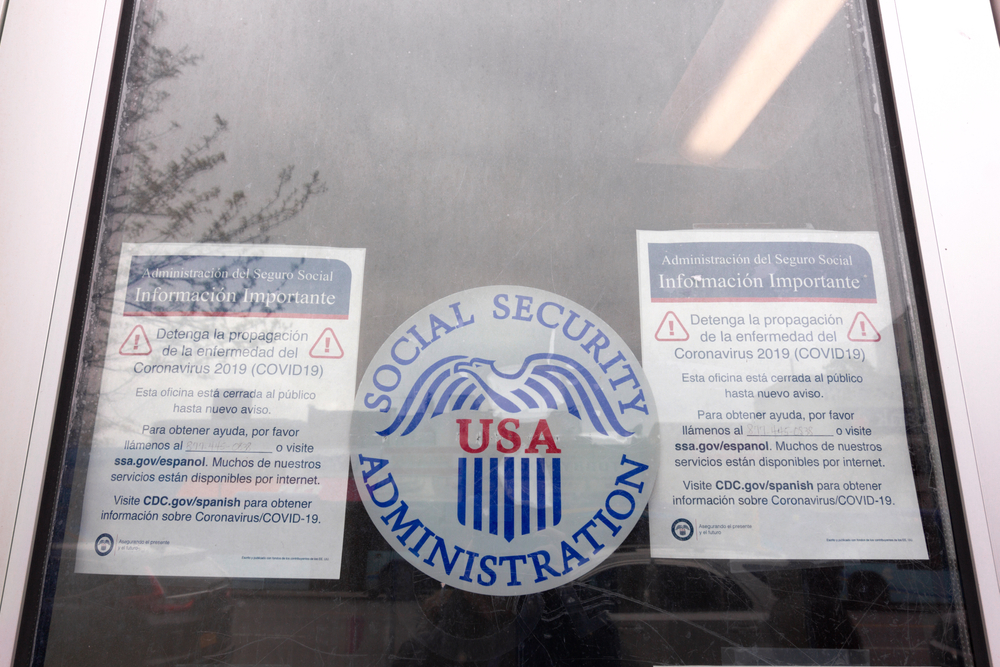

Plaintiffs in a class-action lawsuit against the Social Security Administration (SSA) might describe it as an open-and-shut case. When the SSA closed its field offices at the onset of the COVID-19 pandemic, it remained open for the purposes of denying benefits. But, plaintiffs say, the agency was effectively shut for low-income elderly adults and people with disabilities who needed to validate claims, or who sought to challenge the agency’s denial of their claims. The result: thousands of beneficiaries whose benefits were wrongfully reduced or discontinued, according to the suit.

Plaintiffs in a class-action lawsuit against the Social Security Administration (SSA) might describe it as an open-and-shut case. When the SSA closed its field offices at the onset of the COVID-19 pandemic, it remained open for the purposes of denying benefits. But, plaintiffs say, the agency was effectively shut for low-income elderly adults and people with disabilities who needed to validate claims, or who sought to challenge the agency’s denial of their claims. The result: thousands of beneficiaries whose benefits were wrongfully reduced or discontinued, according to the suit.

Supplemental Security Income (SSI) is the basic federal safety net program for the elderly, blind and disabled, providing them with a minimum guaranteed income. As of September 2021, some 2.3 million people aged 65 or older were receiving SSI payments.

Local Elder Law Attorneys in Your City

SSI recipients are required to demonstrate that they meet income and resource limits each month in order to qualify for assistance, and they must promptly report any changes in their financial circumstances that might affect their status. Failure to perform this routine, which traditionally many have done in person at local field offices, can result in the denial of benefits and a demand for repayment of benefits already sent.

While the SSA made provisions for people to report their information by phone, fax or mail after closing its offices in March 2020, this was easier said than done for the elderly and people with disabilities, according to the lawsuit, filed in U.S. District Court, Eastern District of New York, by the advocacy group Justice in Aging and others on behalf of a group of SSI recipients whose benefits were unlawfully reduced or terminated.

“These recipients—who are disabled, elderly, or both—are at high risk for serious consequences from COVID-19, which limits their ability to venture into their communities to secure needed documentation, go to the post office or to send faxes to SSA,” the lawsuit reads. Furthermore, even when recipients did file their information on time, often the SSA failed to process it for months, only to rule later that the beneficiaries had been overpaid and would have their future benefits docked.

Even a no-fault waiver of overpayment debts that the SSA issued in August 2020 did not mitigate the issue, because it was too limited, the lawsuit argues. For instance, to qualify for the waiver, the overpayment had to have occurred before September 30, 2020, and must have been brought to the SSA’s notice by the end of that year. Many people weren’t informed about the waiver, the lawsuit claims, and therefore could not apply for it.

Nearly 300,000 people have stopped receiving SSI since the closure of the offices, during a pandemic that has hit the elderly and those with disabilities particularly hard, the lawsuit notes. “Adults 65 and older have been the most at risk of death from COVID-19 and have constituted almost 80 percent of COVID-19 deaths. In addition, the risk of death from COVID-19 for persons with disabilities has been three times that of the general population.”

The plaintiffs, who are also represented by New York Legal Assistance Group and law firm Arnold & Porter Kaye Scholer LLP, have demanded a jury trial.

Read Justice in Aging’s press release on the litigation.

A U.S. district court has approved a settlement agreement between the Social Security Administration and a group of individua...

Read moreMy mother, who is 79, recently moved out of her home and into an apartment closer to me so I can help care for her. She...

Read moreIf your resources are above the Supplemental Security Income (SSI)?program?s resource limits of $2,000 for an individual or $...

Read moreIn addition to nursing home care, Medicaid may cover home care and some care in an assisted living facility. Coverage in your state may depend on waivers of federal rules.

READ MORETo be eligible for Medicaid long-term care, recipients must have limited incomes and no more than $2,000 (in most states). Special rules apply for the home and other assets.

READ MORESpouses of Medicaid nursing home residents have special protections to keep them from becoming impoverished.

READ MOREIn addition to nursing home care, Medicaid may cover home care and some care in an assisted living facility. Coverage in your state may depend on waivers of federal rules.

READ MORETo be eligible for Medicaid long-term care, recipients must have limited incomes and no more than $2,000 (in most states). Special rules apply for the home and other assets.

READ MORESpouses of Medicaid nursing home residents have special protections to keep them from becoming impoverished.

READ MORECareful planning for potentially devastating long-term care costs can help protect your estate, whether for your spouse or for your children.

READ MOREIf steps aren't taken to protect the Medicaid recipient's house from the state’s attempts to recover benefits paid, the house may need to be sold.

READ MOREThere are ways to handle excess income or assets and still qualify for Medicaid long-term care, and programs that deliver care at home rather than in a nursing home.

READ MORECareful planning for potentially devastating long-term care costs can help protect your estate, whether for your spouse or for your children.

READ MOREIf steps aren't taken to protect the Medicaid recipient's house from the state’s attempts to recover benefits paid, the house may need to be sold.

READ MOREThere are ways to handle excess income or assets and still qualify for Medicaid long-term care, and programs that deliver care at home rather than in a nursing home.

READ MOREMost states have laws on the books making adult children responsible if their parents can't afford to take care of themselves.

READ MOREApplying for Medicaid is a highly technical and complex process, and bad advice can actually make it more difficult to qualify for benefits.

READ MOREMedicare's coverage of nursing home care is quite limited. For those who can afford it and who can qualify for coverage, long-term care insurance is the best alternative to Medicaid.

READ MOREMost states have laws on the books making adult children responsible if their parents can't afford to take care of themselves.

READ MOREApplying for Medicaid is a highly technical and complex process, and bad advice can actually make it more difficult to qualify for benefits.

READ MOREMedicare's coverage of nursing home care is quite limited. For those who can afford it and who can qualify for coverage, long-term care insurance is the best alternative to Medicaid.

READ MOREDistinguish the key concepts in estate planning, including the will, the trust, probate, the power of attorney, and how to avoid estate taxes.

READ MORELearn about grandparents’ visitation rights and how to avoid tax and public benefit issues when making gifts to grandchildren.

READ MOREUnderstand when and how a court appoints a guardian or conservator for an adult who becomes incapacitated, and how to avoid guardianship.

READ MOREWe need to plan for the possibility that we will become unable to make our own medical decisions. This may take the form of a health care proxy, a medical directive, a living will, or a combination of these.

READ MOREDistinguish the key concepts in estate planning, including the will, the trust, probate, the power of attorney, and how to avoid estate taxes.

READ MORELearn about grandparents’ visitation rights and how to avoid tax and public benefit issues when making gifts to grandchildren.

READ MOREUnderstand when and how a court appoints a guardian or conservator for an adult who becomes incapacitated, and how to avoid guardianship.

READ MOREWe need to plan for the possibility that we will become unable to make our own medical decisions. This may take the form of a health care proxy, a medical directive, a living will, or a combination of these.

READ MOREUnderstand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage.

READ MORELearn who qualifies for Medicare, what the program covers, all about Medicare Advantage, and how to supplement Medicare’s coverage.

READ MOREWe explain the five phases of retirement planning, the difference between a 401(k) and an IRA, types of investments, asset diversification, the required minimum distribution rules, and more.

READ MOREFind out how to choose a nursing home or assisted living facility, when to fight a discharge, the rights of nursing home residents, all about reverse mortgages, and more.

READ MOREUnderstand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage.

READ MOREWe explain the five phases of retirement planning, the difference between a 401(k) and an IRA, types of investments, asset diversification, the required minimum distribution rules, and more.

READ MOREFind out how to choose a nursing home or assisted living facility, when to fight a discharge, the rights of nursing home residents, all about reverse mortgages, and more.

READ MOREGet a solid grounding in Social Security, including who is eligible, how to apply, spousal benefits, the taxation of benefits, how work affects payments, and SSDI and SSI.

READ MORELearn how a special needs trust can preserve assets for a person with disabilities without jeopardizing Medicaid and SSI, and how to plan for when caregivers are gone.

READ MOREExplore benefits for older veterans, including the VA’s disability pension benefit, aid and attendance, and long-term care coverage for veterans and surviving spouses.

READ MOREGet a solid grounding in Social Security, including who is eligible, how to apply, spousal benefits, the taxation of benefits, how work affects payments, and SSDI and SSI.

READ MORELearn how a special needs trust can preserve assets for a person with disabilities without jeopardizing Medicaid and SSI, and how to plan for when caregivers are gone.

READ MOREExplore benefits for older veterans, including the VA’s disability pension benefit, aid and attendance, and long-term care coverage for veterans and surviving spouses.

READ MORE